The main message in the latest marketing campaign to target tax crime in the building sector has raised a few eyebrows.

Inland Revenue has been warning in a series of radio ads and billboards over the past few weeks that “every undeclared cash job leaves a trail”.

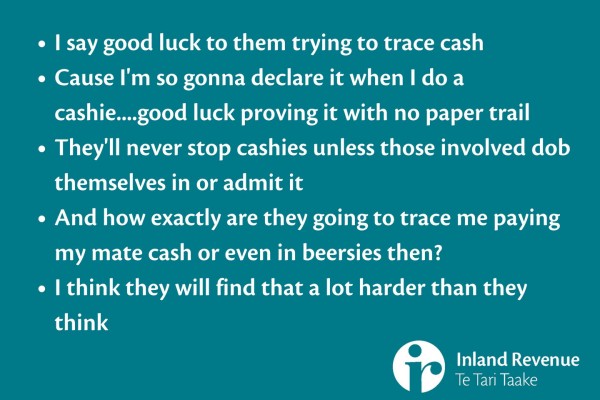

Investigations and Advice Manager Tony Morris says this claim has been met with a few unbelieving responses on social media and in some smoko rooms around the country.

“I want to reassure people that the message is 100% true.

“Typically, with cash you have to spend it some time. So whether it goes on travel, living expenses, a new skill saw, gambling, the mortgage or anything else – we can find it.”

A selection of comments from social media

Here are three examples:

Cash payments made through internet banking leave a trail

Undeclared cash payments that are deposited into a business account are particularly hard to explain so sometimes the money might be directed to a family member’s account to hide the evidence. When money is moved to, or between accounts, there is a trail.

“Everything’s traceable,” says Mr Morris. “Mortgage payments on a property and instalments on the work vehicle will still need to be made and that money needs to come from somewhere. Our investigators often find this is funded from an account other than the main business one. Suddenly a trail that leads to a cash job appears.”

Asset purchases leave a trail

When Inland Revenue investigators see that an asset such as new equipment hasn’t been purchased through the business accounts they get suspicious.

“We put the onus on the business owner to explain how they funded the purchase,” says Mr Morris. “It’s easy for us to see when the asset purchases don’t align with their declared income.

“Often when we look at the accounts of a tradie we suspect has been doing undeclared cash jobs, we see plenty of evidence of supplies being bought, such as paint, carpet and timber but no evidence of any work being done. Unless they can show us their stockpile of supplies another undeclared cash job is usually uncovered.”

Lifestyle expenditure leaves a trail

Cash is often used to fund lifestyle spending on things like overseas holidays or gambling. Funding for these activities can be hard to explain to investigators when very little has been drawn down from the business account.

“Many people won’t be aware but the Tax Administration Act gives us the power to access a wide variety of personal information,” says Mr Morris.

“This includes but is not limited to: any information held about you by other Government departments such as Customs, Land Information New Zealand, and Land Transport New Zealand as well as records from national and international banks, spending with loyalty cards from retailers and with commercial organisations like Trade Me, electricity companies, and casino or gambling accounts.

“Our international information exchange agreements also allow us to request data from more than 60 countries.

Inland Revenue's campaign out in the community

“If someone decides to not declare a cash job, we have plenty of means at our disposal to follow the trail – even simple Internet searches can reveal plenty of incriminating information.

“Tradies and anyone else not declaring cash jobs should realise that it’s not worth the risk to your business and reputation.

“There are plenty more examples of how an undeclared cash job leaves a trail and our investigators are uncovering new leads every day. We will get better and better at finding these inconsistencies.”

The best advice is to record every job, declare every dollar and make sure GST is charged if required.

Inland Revenue can help put right past tax returns. Find out more at www.ird.govt.nz/getitright.

Media contact: Baden Campbell 029 8901674