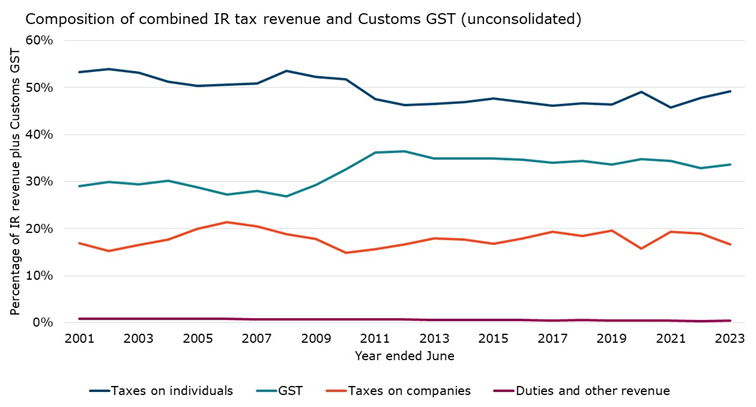

In the year to June 2023, taxes on individuals contributed 49% of the total Inland Revenue (IR) tax revenue and net Customers GST collected, an increase of 1% since the year to June 2022.

This graph has 4 lines showing the relative shares of components of Net Inland Revenue taxes and Customs GST from June 2001 to June 2023. Because these are relative shares, they all add to 100%. The graphed components from largest to smallest are taxes on individual, GST, taxes on companies, and duties and other revenue streams.

On 1 October 2010, the rate of GST was increased from 12.5% to 15% and the tax rates on personal incomes were reduced. The company income tax rate was also reduced in the 2009 and 2012 tax years. The combined effect of these changes was to increase the overall proportion of taxes collected as GST while reducing the taxes collected from individuals and companies.

On 1 April 2021 top personal tax rate of 39% in income over $180,000 was introduced. The effect of this change combined with strong salary and wage growth since 2020 and an increasing average tax rate under a progressive personal income tax scale, has been to increase the share of revenue from taxes on individuals from 46% in 2021 to 49% in 2023.