The data for these statistics is available for download from the links at the bottom of the page. It only includes taxes and duties collected by Inland Revenue.

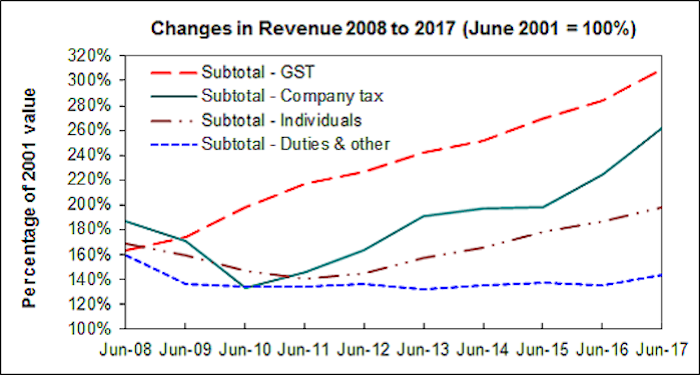

Graph of the changes in revenue collected from 2008 to 2017

This graph has four lines showing the GST, company tax, individuals and duties and other revenue streams from June 2008 to June 2017.

The changes are that:

- total tax revenue grew 35% overall (not shown on graph) from $51,255m to $69,223m

- GST revenue has increased 89% (from $9,487m to $17,900m)

- company tax has fluctuated quite markedly; culminating in a net increase of 40% (from $10,750m to $15,075m)

- individuals' revenue has increased 17% (from $30,591m to $35,864m)

- duties and other revenue has decreased 10% (from $427m to $384m).

Notes

- Measurement is unconsolidated and is on an accruals basis. Changes to accounting policies have affected the figures as follows:

- Provisional tax estimation is included in company tax and other personal tax revenue in the June 2006 and subsequent years. Before June 2006, provisional tax was not estimated at the time the income was earned, but was instead recognised at the due date. The accounting change had the effect of a bring-forward of some tax revenue into 2006.

- Bad debt write-offs have been reported separately as an expense and are no longer netted against tax revenue from the June 2008 year onwards.

- Source deductions include pay as you earn (PAYE) income tax paid through employers, and ESCT (employer superannuation contribution tax).

- Other persons net includes:

- income tax paid directly to Inland Revenue by individuals, Māori authorities and trusts, net of refunds.

- both provisional tax and terminal tax. Refunds include donations, redundancy, and housekeeper rebates.

- Company tax net includes:

- income tax paid directly to Inland Revenue by companies, unit trusts, superannuation funds, PIEs, and clubs and societies, net of refunds.

- both provisional tax and terminal tax.

- Inland Revenue GST includes GST collected and/or refunded by Inland Revenue. It does not include GST collected on imports by the New Zealand Customs Service (this information is available on the Treasury website).

Last updated:

28 Apr 2021