In the year to March 2025, net Inland Revenue GST totalled $28,497 million up 1.0% on last year. In the previous year to March 2024, net Inland Revenue GST grew by 12.9%.

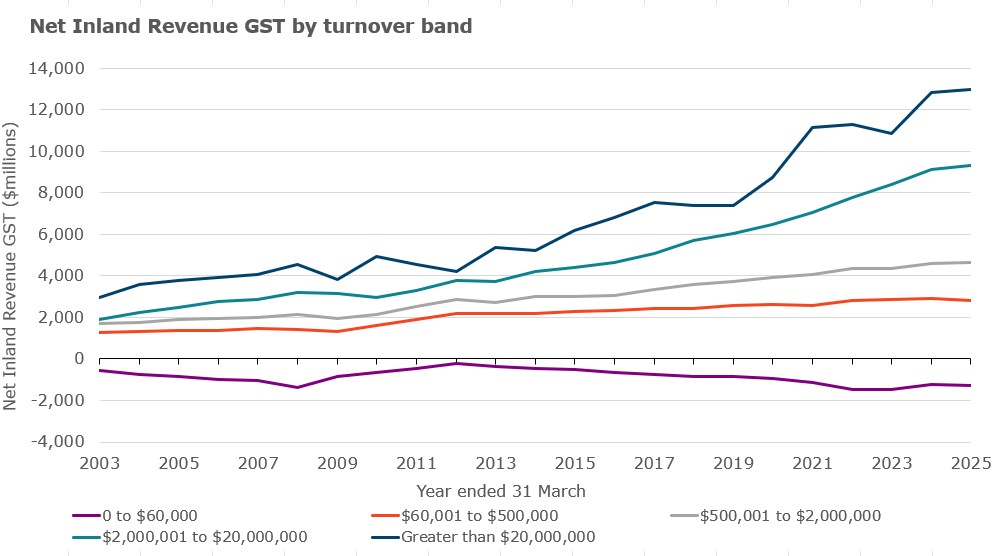

The graph above shows net GST Inland Revenue collected by turnover band, from the year ended March 2003 to the year ended March 2025.

Most growth in net Inland Revenue GST from 2003 to 2025 has been in customers with GST turnover exceeding $2 million. In the year to March 2025:

- Net Inland Revenue GST for customers with turnover between $2 million and $20 million grew by 2.0% for the year to March 2025 (down from the 8.9% growth the previous year).

- For customers with turnover greater than $20 million, net Inland Revenue GST grew by 1.4% for the year to March 2025 (down from 17.7% growth the previous year).

- Net GST increased by 1.5%% for customers in the $500,000 to $2 million turnover band (up 5.5% in the previous year).

- For customers with GST turnover between $60,000 and $500,000, net Inland Revenue GST decreased by 2.2% in the year to March 2025 (up 1.7% increase in the previous year).

In the turnover bands of $60,000 and below, Inland Revenue delivers a net GST refund overall. The net refund has increased from -$1,210 million in the year to March 2024 to -$1,298 million in the year to March 2025.

Last updated:

09 Oct 2025