Inland Revenue’s business transformation programme has made tax and payments simpler, open and more certain for customers. Far more than just a technology upgrade, it has changed every aspect of the way we operate.

Here’s what we learned along the way.

A rare opportunity

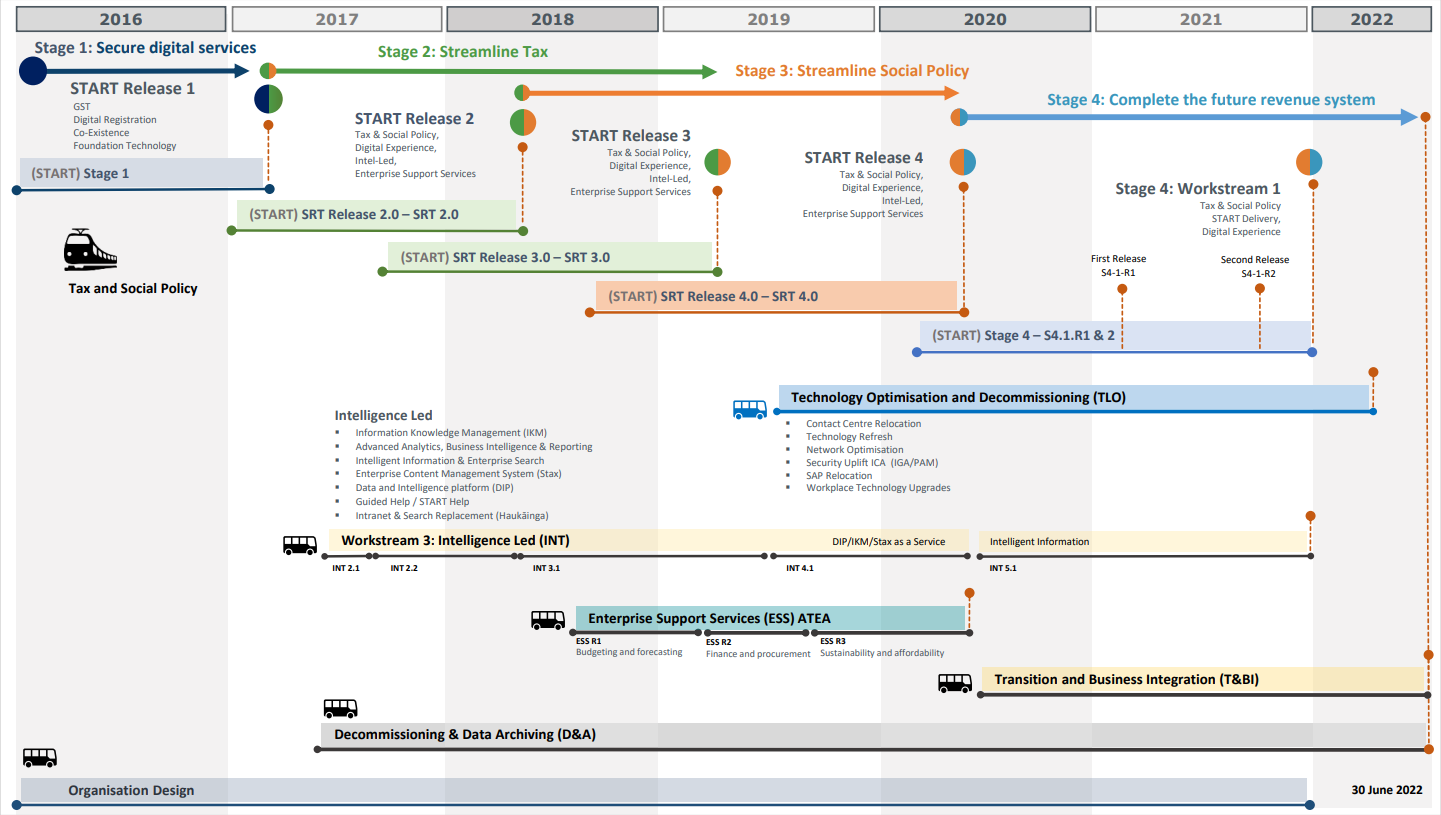

In November 2015, the government agreed to invest in Inland Revenue’s transformation, upgrading the systems we’d been using since the 1980s. The intent was to deliver a modern, digital revenue system that enabled customers to do as much for themselves as possible in a way and at a time that suited them.

But this also provided the opportunity to fundamentally review how we administered the revenue system. This would involve a combination of changes to policy, process, technology, and people capabilities.

| Outcomes of transformation | A fundamentally different revenue system |

|---|---|

| Reduced customer effort and cost | Easy to understand and interact with |

| Improved compliance levels | Near real-time information |

| Make Government policy changes faster and more cost effectively | Digital and highly automated |

| Improved systems resilience | Systems and software do most of the work |

| A more efficient Inland Revenue | More responsive, flexible and certain for customers |

| Future proofed to accommodate change | |

| Services delivered with others inside and outside government |

Where we are now

We’ve completed our customer-facing changes, with 6 releases across 4 stages implemented successfully on time and under budget. The modern, digital revenue system envisaged by transformation is now in place. The programme closed 30 June 2022, after our old systems were fully decommissioned.